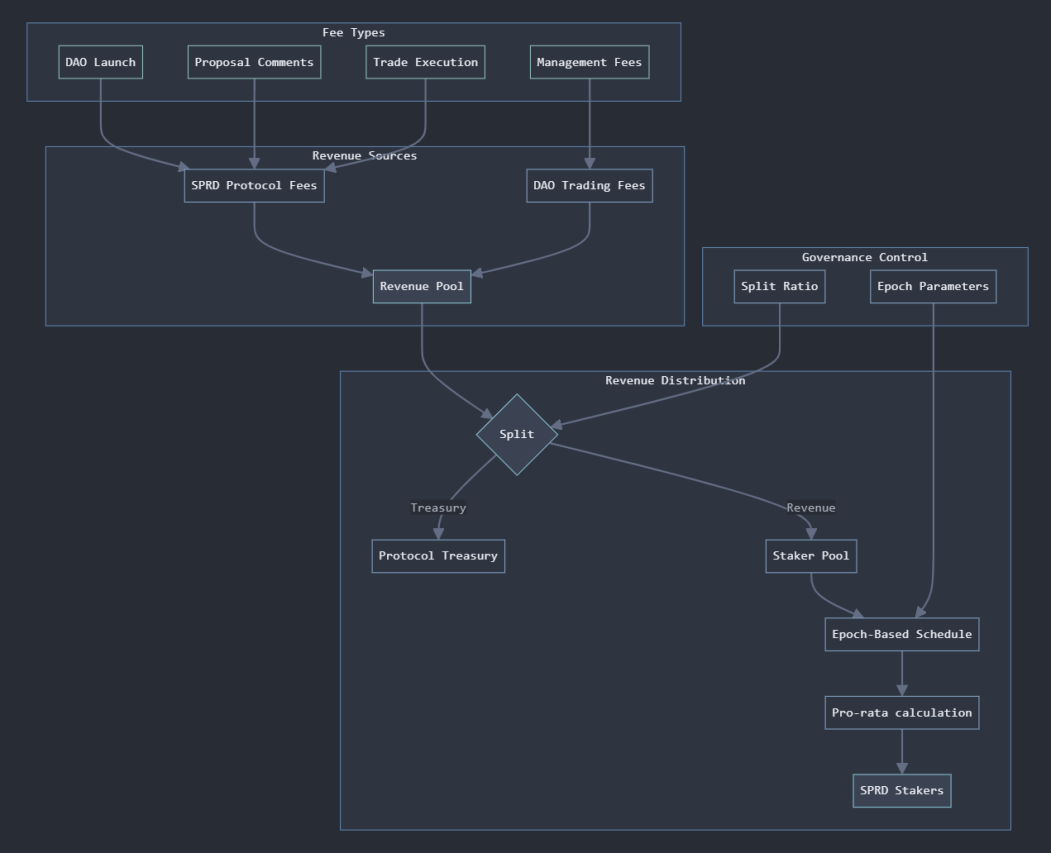

Revenue Distribution

Spreadly implements a dual-stream revenue model that distributes both protocol-level fees and DAO-specific management fees to SPRD token staker. The system ensures fair distribution of platform revenues while incentivizing long-term participation in both the Spreadly protocol and individual DAOs.

Spreadly DAO Streams

The Spreadly protocol generates revenue through two complementary fee sources, which are distributed to protocol stakeholders through a systematic process.

SPRD Protocol Fees

- DAO launch fees for creating new investment DAOs

- Proposal commenting fees

- Trade execution fees

DAO Trading Fees

- Management fees collected from profitable trades

- Denominated in the traded currency

Distribution Process

The revenue distribution process begins with a fundamental split of total revenue between treasury and distribution pools, with the ratio determined by governance decisions. From the distribution pool, rewards are allocated to SPRD stakers on a pro-rata basis according to their individual staked amounts. These distributions occur in 30-day epochs, though this duration can be modified through governance proposals. To participate in a given epoch’s distribution, users must have their tokens staked before the epoch concludes to be considered eligible for rewards.

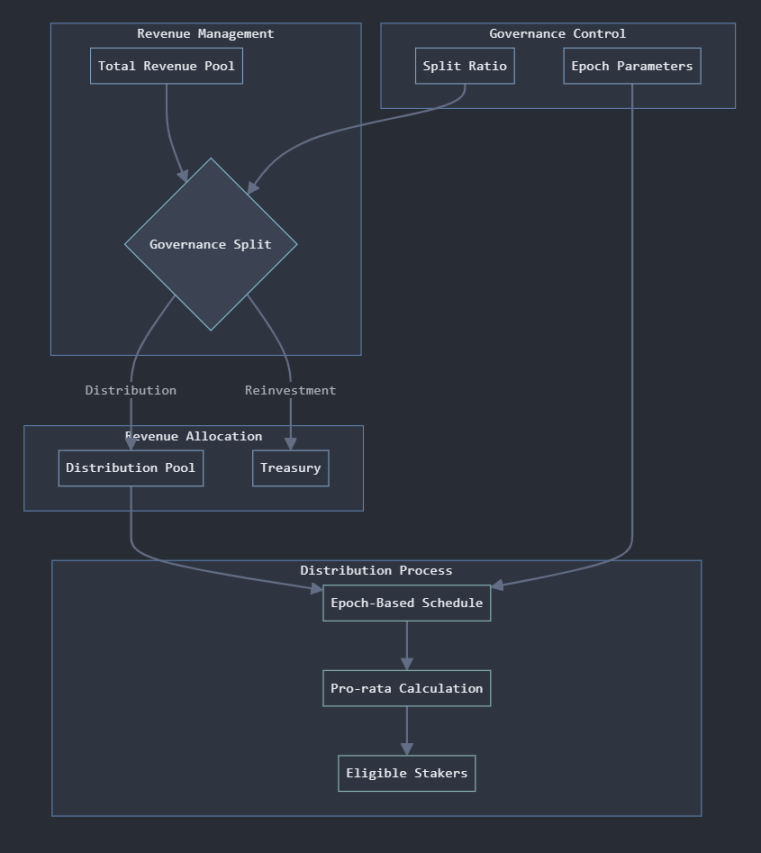

Investment DAO Streams

Investment DAOs implement performance-based reward systems only for profitable trades and investments.

Distribution Process

The revenue management process allows for a flexible allocation between distribution and treasury reinvestment, with the specific ratio determined through governance decisions. When distributed, rewards are allocated pro-rata to participants based on their individual staked token amounts. The distribution follows an epoch-based schedule that can be adjusted through governance mechanisms as needed. Once calculated, eligible stakers can claim their portion of the distributed rewards.